The Stonewell Bookkeeping Ideas

Wiki Article

Some Known Facts About Stonewell Bookkeeping.

Table of ContentsStonewell Bookkeeping Fundamentals ExplainedThe 7-Minute Rule for Stonewell BookkeepingSome Ideas on Stonewell Bookkeeping You Should KnowStonewell Bookkeeping Fundamentals ExplainedStonewell Bookkeeping for Dummies

Every service, from handcrafted cloth makers to game programmers to dining establishment chains, gains and spends cash. You may not fully understand or also begin to fully appreciate what a bookkeeper does.The history of bookkeeping days back to the start of business, around 2600 B.C. Early Babylonian and Mesopotamian bookkeepers maintained records on clay tablet computers to keep accounts of purchases in remote cities. In colonial America, a Waste Book was typically utilized in accounting. It included a daily diary of every purchase in the chronological order.

Small companies might depend solely on an accountant in the beginning, however as they expand, having both professionals aboard ends up being progressively valuable. There are two primary sorts of accounting: single-entry and double-entry bookkeeping. documents one side of a financial purchase, such as including $100 to your cost account when you make a $100 purchase with your bank card.

All about Stonewell Bookkeeping

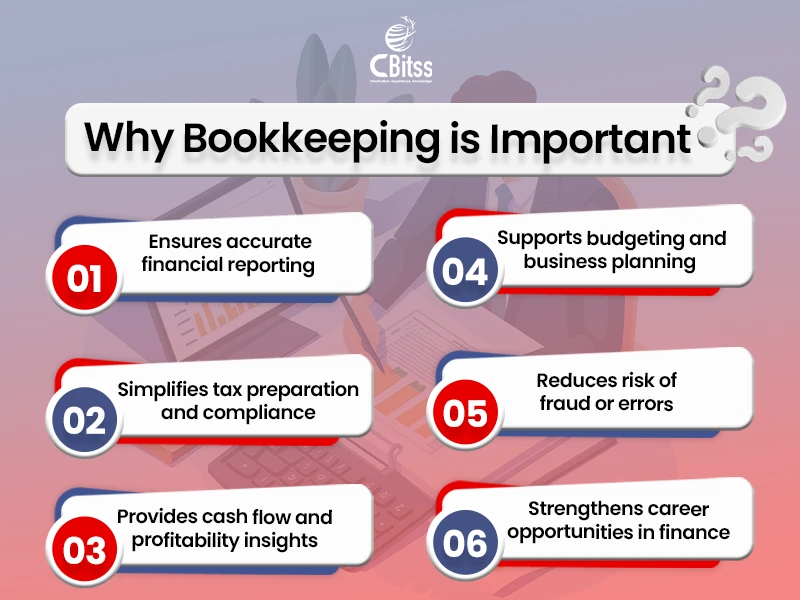

While low-cost, it's time consuming and vulnerable to errors - https://slides.com/hirestonewell. These systems immediately sync with your credit card networks to offer you debt card purchase information in real-time, and instantly code all data around expenditures consisting of jobs, GL codes, areas, and groups.They guarantee that all documentation follows tax guidelines and regulations. They monitor money circulation and frequently create monetary records that assist key decision-makers in an organization to press the company onward. In addition, some bookkeepers additionally help in maximizing payroll and invoice generation for an organization. An effective bookkeeper requires the adhering to skills: Accuracy is crucial in economic recordkeeping.

They generally start with a macro point of view, such as an equilibrium sheet or a profit and loss statement, and then drill right into the information. Bookkeepers make certain that vendor and customer documents are always approximately date, also as people and services modification. They may additionally need to coordinate with other divisions to ensure that everybody is using the same data.

Get This Report about Stonewell Bookkeeping

Bookkeepers swiftly process incoming AP purchases on time and ensure they are well-documented and very easy to audit. Going into costs into the audit system enables precise preparation and decision-making. Bookkeepers quickly create and send invoices that are easy to track and replicate. This aids companies receive payments quicker and boost capital.This aids stay clear of disparities. Bookkeepers frequently carry out physical stock counts to prevent overemphasizing the worth of possessions. This is a crucial aspect that auditors very carefully examine. Include internal auditors and contrast their matters with the videotaped values. Accountants can work as freelancers or internal workers, and their compensation differs depending on the nature of their work.

Freelancers often charge by the hour yet the original source might provide flat-rate packages for specific jobs., the average bookkeeper income in the United States is. Remember that salaries can differ depending on experience, education and learning, area, and market.

Freelancers often charge by the hour yet the original source might provide flat-rate packages for specific jobs., the average bookkeeper income in the United States is. Remember that salaries can differ depending on experience, education and learning, area, and market.The Facts About Stonewell Bookkeeping Uncovered

Some of one of the most usual documentation that organizations have to send to the federal government includesTransaction information Financial statementsTax conformity reportsCash circulation reportsIf your bookkeeping is up to date all year, you can stay clear of a load of stress throughout tax season. small business bookkeeping services. Patience and interest to information are vital to much better bookkeeping

Seasonality is a part of any task worldwide. For accountants, seasonality means periods when payments come flying in via the roof covering, where having exceptional job can become a significant blocker. It comes to be important to expect these moments in advance and to complete any type of backlog before the pressure period hits.

8 Easy Facts About Stonewell Bookkeeping Shown

Preventing this will minimize the threat of setting off an internal revenue service audit as it supplies an exact representation of your funds. Some common to maintain your individual and company financial resources different areUsing a business debt card for all your business expensesHaving different checking accountsKeeping invoices for individual and overhead separate Visualize a world where your bookkeeping is provided for you.Workers can respond to this message with an image of the invoice, and it will instantly match it for you! Sage Expenditure Administration provides extremely personalized two-way assimilations with copyright Online, copyright Desktop, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These integrations are self-serve and need no coding. It can instantly import data such as staff members, projects, classifications, GL codes, departments, work codes, cost codes, tax obligations, and a lot more, while exporting expenditures as costs, journal entrances, or debt card fees in real-time.

Consider the following suggestions: A bookkeeper who has actually collaborated with companies in your sector will certainly better recognize your certain needs. Certifications like those from AIPB or NACPB can be an indication of integrity and capability. Request for references or inspect online reviews to ensure you're hiring someone dependable. is an excellent area to start.

Report this wiki page